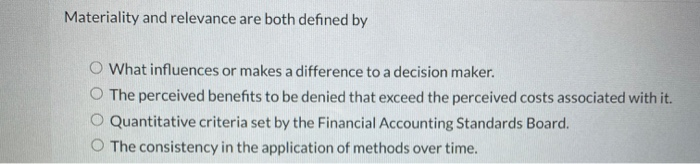

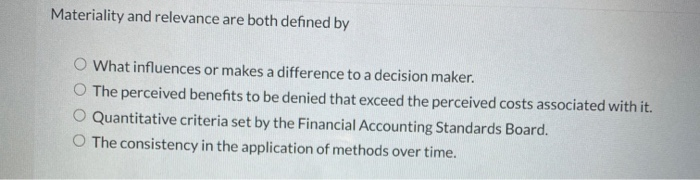

Materiality and Relevance Are Both Defined by

Accounting reporting business financial legal risk and more recently Environmental Social and Governance ESG or sustainability or non-financial issues. In an audit materiality is the concept or expression that refers to the matter that is important in the financial statements.

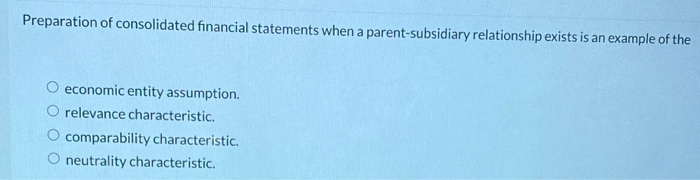

Solved Preparation Of Consolidated Financial Statements When Chegg Com

A decision not to disclose certain information may be made because it is believed that investors or other users have no need for that kind of information it is not relevant or that the amounts involved are too small to make a difference it is not material.

. Therefore materiality and relevance are defined by what influences or makes a difference to a decision maker. The materiality definition in accounting refers to the relative size of an amount. Click to see full answer.

Here is the definition of materiality in conceptual frameworks. Relatively large amounts are material while relatively small amounts are not material or immaterial. Materiality in governmental auditing.

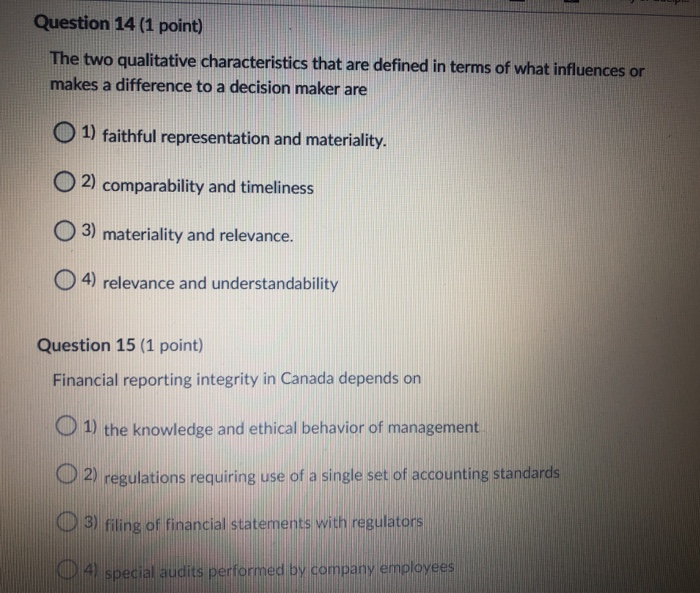

Materiality and relevance are both defined in terms of what influences or makes a difference to a decision maker but the two terms can be distinguished. In the United States a judge presiding over a jury trial will determine. Materiality as well as relevance both are defined in terms of the influence that affect the decision of decision maker.

Materiality and decision relevance are both defined in terms of what influences or makes a difference to a decision-maker. The perceived benefits to be denied that exceed the perceived costs associated with it. What influences or makes a difference to a decision maker.

Materiality Relevance and Admissibility of Evidence. Professional accountants determine materiality by deciding whether a value is material or immaterial in financial reports. Since planning materiality should affect the scope of both tests of controls and substantive tests such differences might be of importance.

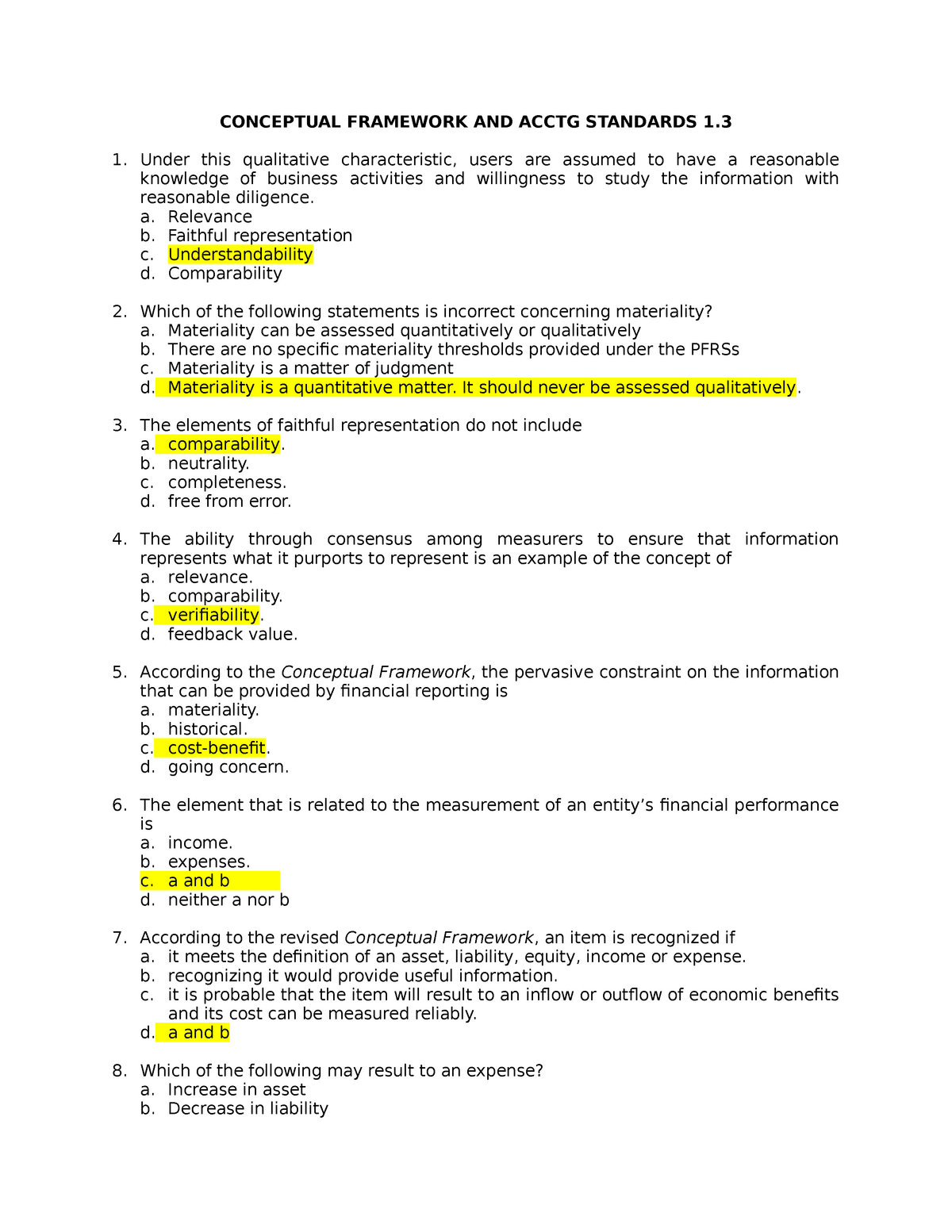

Evidence is inadmissible if it is not relevant. In accounting materiality refers to the relative size of an amount. M ateriality is a concept in financial accounting and reporting that firms may disregard trivial matters but they must disclose everything that is important to the report audience.

To be considered relevant evidence must have any tendency to make the existence of any fact of consequence to the action more or less probable than it would be without the evidence. Relevant information is capable of making a difference in a user s decision. Perhaps the most important reason why materiality is not defined in the ISA is because the principle of materiality is first and foremost a financial reporting rather than an auditing concept.

Two different auditors auditing even the same entity might generate differing scopes of audit procedures solely based on the planning materiality definition used. Materiality and relevance are both defined by What influences or makes a difference to a decision maker. A decision not to disclose certain information may be made say because investors have no need for that kind of information it is not relevant or because the amounts involved are too small to make a difference they are not.

Materiality is an ingredient of relevance as only material information is relevant for taking decisions. The issues that appear on a companies materiality matrix are all expected to be managed at some level. The corollary is equally true.

Materiality and relevance are both defined by. Material evidence is defined as evidence that proves a fact in the case. The misstatements or omission could be qualitative quantitative or both.

The consistency in the application of methods over time. Determining materiality requires professional judgement. Using a standard process for conducting a materiality assessment a company can identify and prioritize the issues that are most material to its business and most relevant to its stakeholders.

The history of the concept dates back to 1867 when the English Court introduced the term material by referring to relevant not negligible fact that. Materiality and relevance are both defined by-Quantitative criteria set by the FASB-What influences or makes a difference to a decision maker-The perceived benefits to be denied that exceed the perceived costs associated with it-The consistency in. A decision not to disclose certain information may be made say because investors have no need for that kind of information it is not relevant or because the amounts involved are too small to make a difference they are not.

What influences or makes a difference to a decision maker. Relevance and Uses of the Materiality Concept in Accounting It is to be understood that materiality is a subjective concept that guides a company to identify and disclose only those transactions which are sufficiently large compared to the operations of the company such that it would concern the users of the financial statements of the company. American Institute of Certified Public Accountants AICPA Codification of Statements on Auditing Standards AU 312 Audit Risk and Materiality in Conducting an Audit states that the auditor should consider audit risk and materiality both in a planning and setting the scope for the audit and b evaluating whether the financial statements taken as a.

A firm may decide to disclose certain information because its users have a need for. In this case a matter is material if it can affect the economic decision making of the users of financial statements. Quantitative criteria set by the Financial Accounting Standards Board.

Jump to navigation Jump to search. O Quantitative criteria set by the Financial Accounting Standards Board. Not surprisingly a fact is of consequence if it is material.

In determining the admissibility of evidence the judge should determine the relevance and materiality of the informationEvidence must be both relevant and material to be admitted. At first blush the relationship between. Materiality and relevance are both defined in terms of what influences or makes a difference to a decision maker but the two terms can be distinguished.

However ISA 320 Materiality in planning and performing an audit does not include a definition for materiality. The consistency in the application of methods over time. The perceived benefits to be denied that exceed the perceived costs associated with it.

For instance a 20000 amount will likely be immaterial for a large corporation with a. The materiality concept helps ensure that organizations do not withhold critical information from investors owners lenders or regulators. From Criminal Defense Wiki.

Materiality is entity specific and related to relevanceif omitting it or misstating it could influence a user s decision. In other words materiality is an entity-specific aspect of relevance based on the nature or magnitude or both of the items to which the information relates in the context of an individual entitys. The Materiality concept applies in a wide variety of contexts.

Likewise the misstatements on financial statements are considered material if they can influence the economic decisions of. Relevant evidence is defined as having material evidence from the scene or case that would have an effect on the jury decision. Materiality is an essential understanding for accurate and ethical accounting so its definition should be strongly considered.

Conceptual Framework And Acctg Standards 1 3 Under This Qualitative Characteristic Users Are Studocu

Solved Preparation Of Consolidated Financial Statements When Chegg Com

Solved Materiality And Relevance Are Both Defined By What Chegg Com

Comments

Post a Comment